The Student Aid Index (SAI) is an essential concept in the world of financial aid for college. It replaced the Expected Family Contribution (EFC) starting with the 2024-2025 Free Application for Federal Student Aid (FAFSA). But what exactly is the SAI, and how does it impact your family’s financial aid eligibility? Let’s take a closer look.

What Is the Student Aid Index?

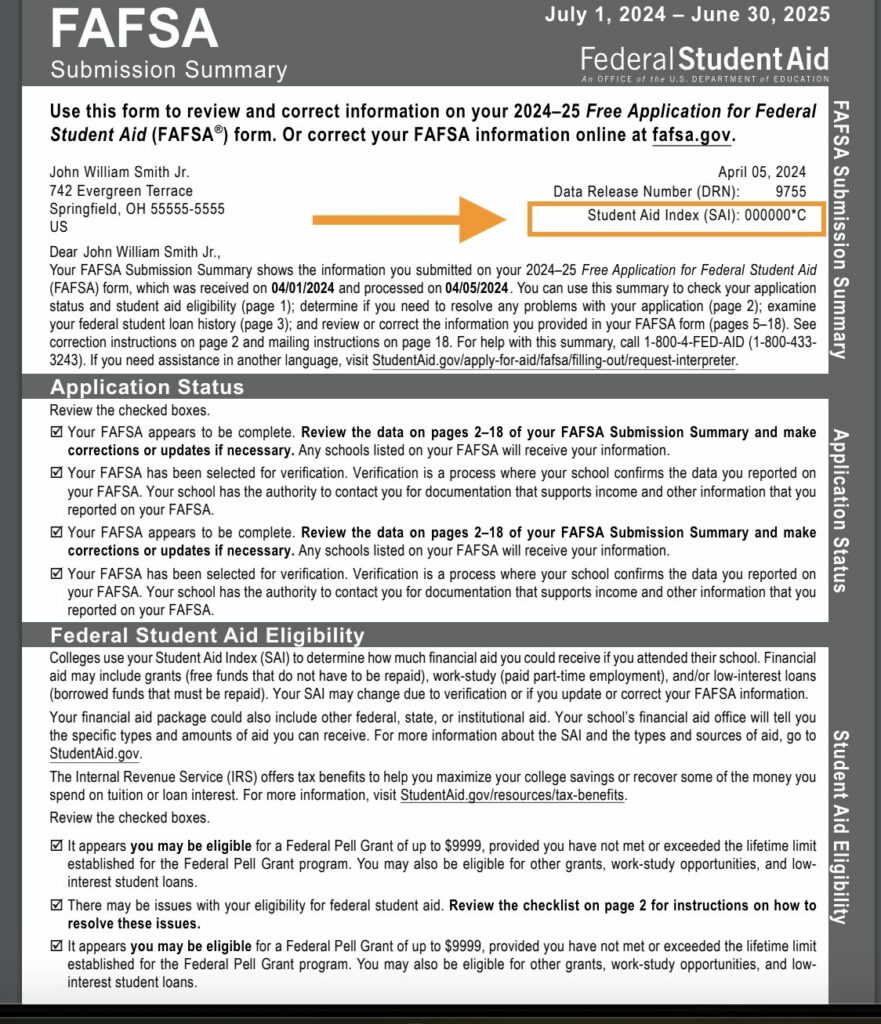

The SAI is an eligibility index number used by college financial aid offices. It helps determine how much federal student aid you would receive if you attended a specific college. Essentially, it’s a numerical representation of your family’s financial need for college. You’ll find this number on your FAFSA Submission Summary (FSS) form, which you receive after submitting the FAFSA.

A student's SAI could range from -1,500 to above 99,999. This number which replaces the EFC is often thought to be the amount a family can expect to pay towards college. However, families can often pay more than this amount. Colleges use this amount to determine a family's financial need (COA-SAI=financial need). The lower your SAI, the higher your financial need which means you could qualify for more need-based aid.

>>RELATED POST: What is the FAFSA?

How Is the SAI Calculated?

The SAI is derived from the information provided in your FAFSA. It takes into account various factors, including your family’s income, assets, household size, and the number of family members attending college. The goal is to better quantify your financial need, allowing colleges to allocate aid more effectively.

How do Colleges Use Your Student Aid Index?

Colleges use the SAI to assess your financial need. Financial Need is calculated by subtracting your SAI from the college's Cost of Attendance (COA), which includes tuition, fees, room and board, books, supplies, and other expenses.

The formula is:

Cost of Attendance (COA) - Student Aid Index (SAI) = Financial Need

Financial Need is considered the amount a family will need in financial aid to be able to afford the college. Some colleges will meet 100% of this financial need with grants and scholarships. However, many colleges might meet this "financial need" with a mix of financial aid that includes loans.

Based on your financial need, colleges put together a financial aid package. This package can include:

- Federal Pell Grants: these are need-based grants for undergraduate students;

- Federal Work-Study: part-time employment opportunities to help students earn money to pay for education expenses);

- Federal Direct Loans: low-interest loans that must be repaid after graduation. These include Subsidized Loans (need-based) and Unsubsidized Loans (not need-based).

- Federal Supplemental Educational Opportunity Grants (FSEOG): Additional grants for students with exceptional financial need.

Colleges may also combine federal aid with state and institutional aid, including scholarships and grants to meet your financial need.

Once the financial aid package is assembled, the college sends you an award letter detailing the types and amounts of aid you can receive.

>>RELATED POST: Financial Aid Guide

What Constitutes a “Good” Student Aid Index (SAI)?

Parents often wonder what constitutes a “good” SAI. However, it’s essential to understand that the SAI itself doesn’t directly award aid. Instead, the Department of Education forwards your FAFSA and SAI information to your chosen college. The college then determines your financial aid package based on a formula, which may include:

- Federal Grants: These are need-based grants provided by the government.

- University Scholarships: Merit-based and need-based scholarships awarded by the college.

- Student Loans: Both subsidized and unsubsidized loans.

- Work-Study Programs: Opportunities for students to work part-time on campus.

Now, let’s talk about the SAI numbers:

- Lowest Possible SAI (-1500): An SAI of -1500 indicates significant financial need. Families with this SAI qualify for the full Pell Grant, a federal grant designed to help low-income students. Additionally, other need-based aid may be available.

- SAI from -1500 to 0: This range still qualifies for the full Pell Grant. However, the availability of other aid depends on the college’s cost of attendance.

- SAI Above 0: If your SAI is above 0, you may still receive a Pell Grant, but it depends on your college’s costs. As your SAI increases, your demonstrated financial need decreases. Once your SAI exceeds 20,000, the chances of need-based aid decrease significantly, except at the most expensive colleges.

Takeaways for Parents

In summary, the Student Aid Index provides a clearer picture of your family’s financial need, helping colleges allocate aid effectively. By understanding the SAI and exploring all available options, parents can make informed decisions to cut college costs for their high school students. Remember, financial aid processes can be complex, so ...

- File the FAFSA: Regardless of your income level, complete the FAFSA. It’s the gateway to federal and state aid, as well as many institutional scholarships.

- Understand Your SAI: Familiarize yourself with your SAI and what it represents. Remember that it’s not the final word on aid but a starting point for colleges to assess your need.

- Explore Other Aid Sources: Look beyond financial aid available through the federal government, state, and colleges. Explore alternative sources of aid, such as private scholarships from foundations (e.g., Coca Cola Scholars Foundation) , corporations (e.g., Lockheed Martin STEM Scholarship), and civic organizations like your local Rotary.

And, don't hesitate to reach out to your college’s financial aid office for personalized guidance.