Student loan repayment has been on pause since the CARES Act was signed into law by Congress in 2020. This measure was a welcome relief to borrowers who were struggling to make payments amid mass layoffs due to COVID-19.

Since then, the Biden Administration has enacted a Student Debt Relief program to erase up to $20,000 in debt relief for Pell recipients and up to $10,000 for non-Pell recipients. Eligibility is based on income. Individuals earning less that $125,000 are eligible, and households earning less than $250,000 are eligible.

However, the Student Debt Relief program is currently being challenged in the courts so the student loan pause remains in effect.

Here are some key things you should know about the student loan pause:

How long will the student loan forbearance (pause) last?

As of January 3, 2023, the student loan pause is still in effect while the Student Debt Relief program is being challenged in the courts.

Since the student debt pause began back in March 2020, interest on any outstanding federal loans will not accrue.

>>RELATED POST: How To Appeal Your Financial Aid Award

Who Do You Need To Contact To Get Student Loan Forbearance

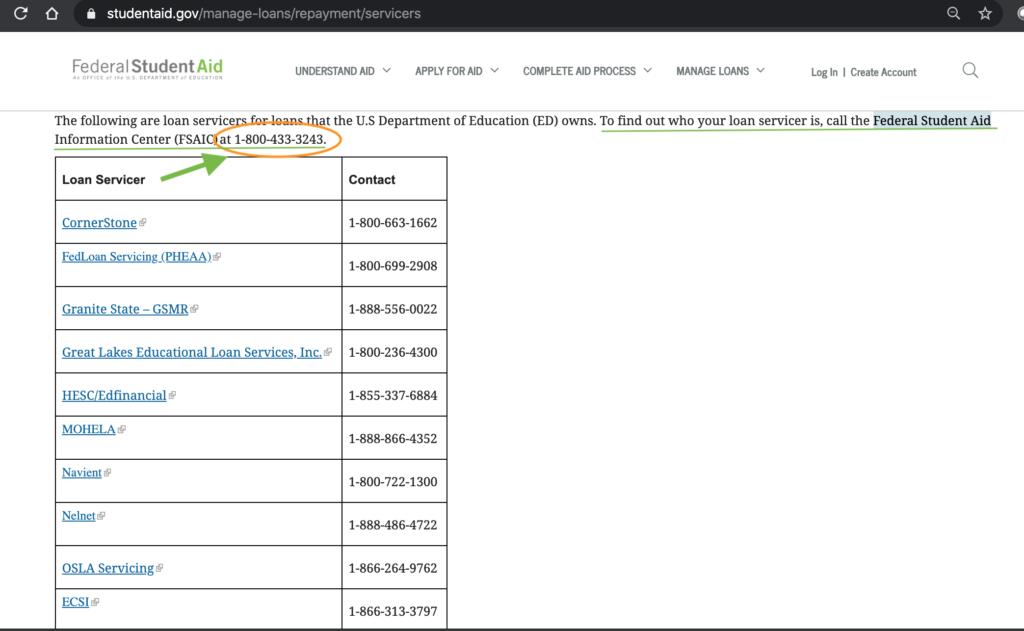

You do not have to do anything if your loan is owned (and serviced) by the US Department of Education. If not, you will have to contact your loan servicer directly to request a pause in your payments.

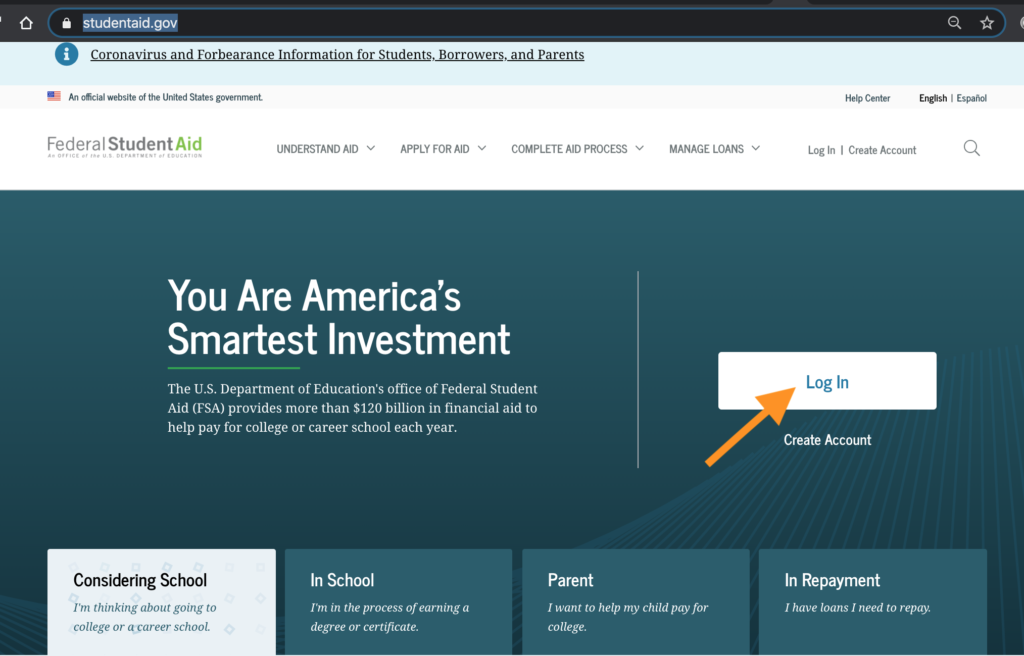

To find your loan servicer, contact the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243. Another place to find information relevant to your loan, is to log into your account by visiting My Federal Student Aid.

Types of Loans Eligible For Forbearance

According to the US Department of Education, this forbearance or pause only applies to federal loans.

If you have private student loans, you'll have to contact the institution and make a request to defer your payments. Private institutions were offering some relief to loan borrowers on a case-by-case basis.

In addition, some states have provided relief to student loan borrowers. New York State Department of Financial Services, for example, secured debt relief for up to 300,000 private student loan borrowers. To take advantage of this program, borrowers have to reach out to their loan servicer.

Do You Have to Use the Student Loan Forbearance?

The simple answer is no. You can still make loan payments although the CARES Act has authorized a pause. If you can afford to continue making your loan payments, you probably should. Doing so will help you get rid of your student debt sooner rather than later.

Student Loans In Default

All federal student loans in default when the CARES Act was enacted on March 13, 2020 received some relief. For example, borrowers did not have their wages garnished and they were also eligible to not have their tax return withheld if they filed income tax returns during this period. The Department of Education has ordered all private collection companies to temporarily halt collection procedures.

For more information, contact the Education Department’s Resolution Group at 1-800-621-3115 if you are interested in consolidating your student loans or a loan rehabilitation program.

Important Resources

To find your federal student loan servicer, please call the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243 or log into your account at My Federal Student Aid.